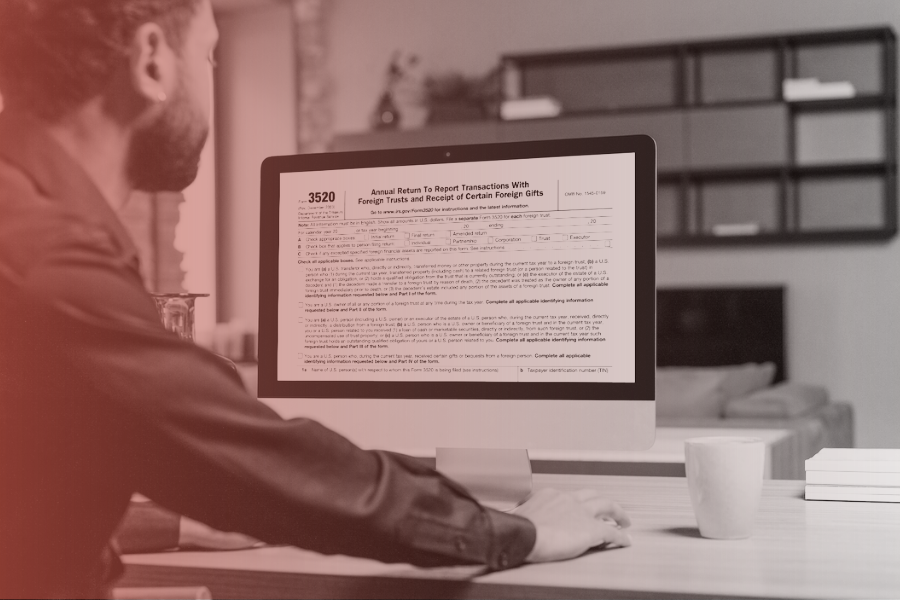

Everything You Need to Find Out About Reporting a Foreign Gift: A Comprehensive Guide

Coverage foreign presents is an important aspect for U.S. institutions. Understanding the lawful requirements and the effects of non-compliance is critical for maintaining honesty. Institutions need to navigate complicated reporting limits and deadlines. Proper documentation plays a crucial role in this procedure. As the landscape of international donations advances, establishments have to adjust their techniques accordingly. What are the very best methods to assure compliance and transparency?

Understanding Foreign Presents: Interpretation and Extent

While many institutions may obtain various forms of support, comprehending international gifts needs a clear definition and range. International gifts refer to any kind of funds, solutions, or materials offered by foreign entities, individuals, or governments to united state establishments. These gifts can come in various kinds, consisting of cash money payments, home, research study funding, and scholarships.

The scope of international presents includes not only direct monetary support but likewise in-kind contributions that could affect the institution's procedures or research top priorities. It is essential for establishments to acknowledge the implications of approving such presents, as they may lug particular problems or expectations from the benefactor. Recognizing the subtleties of foreign presents aids companies in maintaining openness and accountability while cultivating international relationships. Inevitably, an extensive grasp of international gifts is important for institutions to browse the intricacies of funding and copyright their stability in the academic and study community.

Lawful Requirements for Reporting Foreign Gifts

Additionally, federal guidelines might demand openness pertaining to the resources of financing, specifically if connected to delicate research locations. Organizations need to preserve precise records of foreign gifts, assuring they can confirm reported payments during audits. This process typically calls for cooperation among different institutional departments, including finance, lawful, and conformity teams, to guarantee adherence to both institutional plans and government guidelines. Comprehending these lawful frameworks is necessary for institutions to efficiently take care of and report international gifts.

Trick Reporting Thresholds and Deadlines

Establishments must understand particular reporting thresholds and deadlines to confirm compliance with guidelines concerning international gifts. The United State Division of Education calls for organizations to report any type of international gifts exceeding $250,000 within a calendar year. This threshold incorporates both private presents and advancing payments from a single foreign source.

Furthermore, establishments need to report any foreign gifts going beyond $100,000 to the Foreign Professionals Enrollment Act (FARA) if the presents are connected to lobbying or political activities.

Deadlines for reporting are crucial; establishments are commonly needed to send annual records by July 31 for gifts obtained throughout the previous . Failing to fulfill these limits or deadlines may lead to fines, consisting of loss of government funding. Therefore, establishments must develop a thorough monitoring and reporting process to assure adherence to these crucial policies.

How to Properly Record and Record Foreign Gifts

Proper paperwork and reporting of foreign gifts require a clear understanding of the needed conformity actions. This consists of adhering to a needed documentation checklist and complying with well established reporting procedures. Legal considerations should also be considered to guarantee full conformity with applicable regulations.

Called For Documents List

Exact documents is crucial when reporting foreign presents to establish compliance with governing demands. Organizations must keep an in-depth record of each gift, consisting of the donor's name, the amount or worth of the present, and the day it was obtained. Additionally, a description of the purpose of the present and any kind of limitations enforced by the benefactor should be documented. Document with the donor, such as letters or e-mails, can supply context and confirmation. It is also crucial to consist of any relevant arrangements or contracts. Financial records, such as bank declarations or invoices, ought to support the worth of the present. Correct company and retention of these documents will certainly help with the reporting procedure and warranty adherence to standards.

Reporting Procedures Review

When steering the intricacies of reporting foreign gifts, it is vital to adhere to recognized treatments to assure compliance with governing criteria. Organizations has to begin by identifying the nature and value of the gift, ensuring precise documentation. This includes compiling invoices, contributor communication, and any type of pertinent contracts. Next, entities ought to submit the needed types to the proper governmental bodies, commonly including the Division of Education and learning or various other assigned agencies. It is essential to follow target dates, as tardy submissions may lead to charges. Additionally, maintaining extensive records of the reporting procedure is important for future audits. Lastly, organizations must educate their personnel on these procedures to assure consistent conformity across all divisions.

Conformity and Legal Factors To Consider

Just how can companies assure they fulfill compliance and here lawful standards when recording international presents? To identify adherence, institutions should establish a thorough reporting framework that includes clear meanings of foreign gifts and thresholds for reporting demands. Exact documentation is vital, necessitating thorough documents of the gift's function, resource, and value. Organizations must implement internal policies for prompt reporting to relevant authorities, including federal firms, as stated by the Foreign Gifts and Agreements Disclosure Act. Educating team on conformity protocols and maintaining open lines of interaction with lawful advice can further enhance adherence. Regular audits of foreign present documents techniques will certainly aid recognize possible conformity voids, assuring companies maintain legal standards while fostering transparency in their financial relationships.

Consequences of Non-Compliance in Coverage

Failing to adhere to foreign gift coverage needs can result in significant lawful fines for establishments. Furthermore, non-compliance might taint an establishment's track record, weakening count on with stakeholders. Understanding these consequences is important for maintaining both honest and lawful standards.

Lawful Penalties for Non-Compliance

Non-compliance in reporting foreign presents can result in considerable legal charges that may adversely affect organizations and people alike. The Federal federal government strictly implements policies bordering foreign payments, and infractions can result in serious repercussions, consisting of hefty fines. Institutions may deal with fines getting to thousands of bucks for each instance of non-compliance, depending on the quantity of the unreported present. Additionally, people associated with the reporting procedure might encounter individual obligations, consisting of fines or possible criminal costs for willful disregard. The potential for audits boosts, leading to further scrutiny of financial methods. On the whole, understanding and sticking to reporting demands is important to avoid these significant lawful implications and warranty conformity with federal policies.

Influence On Institutional Online Reputation

While lawful penalties are a substantial concern, the influence on an institution's credibility can be similarly extensive when it comes to failing to report foreign gifts. Non-compliance can lead to public distrust, destructive connections with stakeholders, graduates, and possible donors. Organizations run the risk of being regarded as untrustworthy or doing not have transparency, which can deter future funding chances. Additionally, unfavorable media protection might intensify these problems, leading to a lasting stain on the organization's photo. This disintegration of online reputation can have significant effects, including lowered enrollment, challenges in employment, and check my source weakened partnerships with other academic or research study institutions. Eventually, the failing to follow reporting needs not just threatens monetary security however likewise endangers the integrity and trustworthiness of the establishment itself.

Ideal Practices for Handling Foreign Presents in Organizations

Efficiently taking care of foreign gifts in organizations calls for a structured method that focuses on openness and compliance. Organizations need to establish clear policies describing the acceptance, reporting, and utilization of international presents. A devoted committee can manage these plans, guaranteeing they straighten with both governing needs and institutional worths.

Regular training for staff associated with present monitoring is important to preserve awareness of compliance obligations and honest factors to consider. Establishments have to perform extensive due persistance on potential foreign contributors to examine any kind of possible risks connected with accepting their gifts.

Additionally, open interaction with stakeholders, consisting of professors and trainees, promotes depend on and minimizes issues regarding international impacts. Regular audits of foreign present purchases can aid recognize any kind of inconsistencies and maintain click over here now accountability. By executing these ideal techniques, organizations can efficiently browse the intricacies of receiving international gifts while safeguarding their integrity and reputation.

Regularly Asked Concerns

What Kinds Of Foreign Present Are Exempt From Reporting?

Can Foreign Present Be Made Use Of for Personal Expenditures?

Foreign gifts can not be used for personal costs. They are planned for details purposes, often pertaining to institutional or educational support, and mistreating them for individual gain can cause lawful and moral consequences.

Exist Penalties for Late Coverage of Foreign Present?

Yes, penalties can be enforced for late reporting of international presents. These might include penalties or restrictions on future funding. Prompt conformity is necessary to stay clear of prospective legal and economic repercussions linked with such coverage requirements.

Exactly How Do International Gifts Impact Tax Obligations?

Foreign gifts may influence tax obligations by possibly going through reporting requirements and, in some instances, tax. Recipients have to reveal these gifts to ensure compliance with internal revenue service laws and prevent charges or unanticipated tax obligation liabilities.

Can Establishments Decline International Gifts Without Coverage?

Institutions can decline international gifts without reporting them, as there is no commitment to accept contributions. report a foreign gift. If approved, they should stick to regulatory requirements pertaining to disclosure and potential ramifications on tax obligation obligations.